How Much Tax Will I Pay On £1500 A Month? Find Out Now! 🔴 2023 Updated

The calculator will show that the marginal tax rate for a single person with $50,000 in taxable income is 22%. As discussed above, the U.S. tax system is "progressive," so not all of your.

«Два раза в год я разоряюсь» — Грант Кардоне объясняет, почему 31 декабря он купил два вертолета

The rate on the first $11,000 of taxable income would be 10%, then 12% on the next $33,725, then 22% on the final $5,275 falling in the third bracket. This is because marginal tax rates only apply to income that falls within that specific bracket.

How to Pay Taxes Quarterly A Simple Tax Guide for the Self Employed

Before filing your 2023 return, estimate your IRS refund, or how much you owe, and see your effective tax rate using our free income tax calculator.

4 Things You Need To Know Before Paying Your Tax Bill GOBankingRates

Derive your local income tax liability; Figure out your net pay; Get your paycheck numbers; How much is a paycheck on a 40000 salary? You will receive $2,843.67 monthly after federal tax liability for a single filer. The monthly paycheck is $2,988.33 after federal tax liability for married filed jointly with no dependent

Life of Tax How Much Tax is Paid Over a Lifetime Self.

Starting at $55. + $49 per state filed. Start with Deluxe. Get real-time assistance at any step of your tax prep. Get help from a live expert & our AI Tax Assist NEW. Designed for more complicated tax situations. Options for deductions, investors, & self-employed. Learn more.

How to Calculate Tax on Salary (With Example)

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes to the federal income tax brackets and rates. Tax filing status. Taxable gross annual income subject to ordinary.

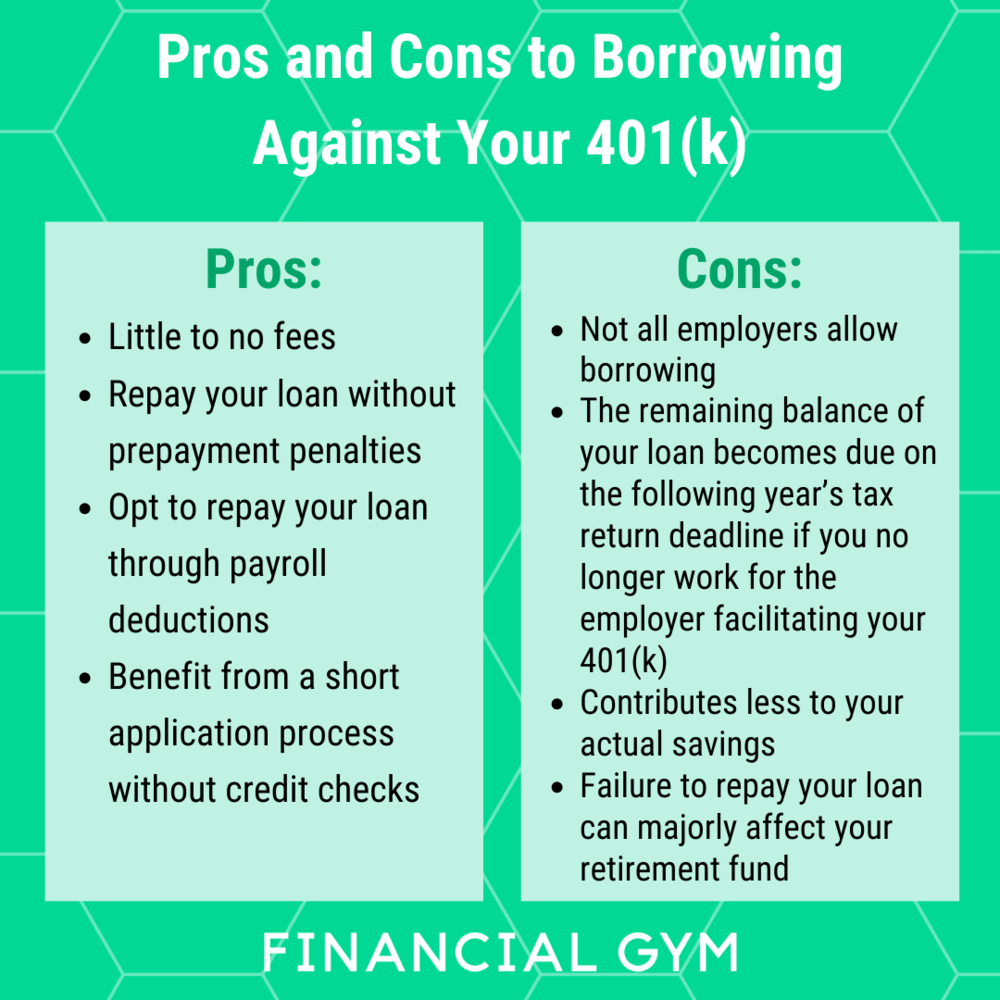

How much tax will I pay on my 401k? Encinitas Daily News

For example, let's look at a salaried employee who is paid $52,000 per year: If this employee's pay frequency is weekly the calculation is: $52,000 / 52 payrolls = $1,000 gross pay. If this employee's pay frequency is semi-monthly the calculation is: $52,000 / 24 payrolls = $2,166.67 gross pay.

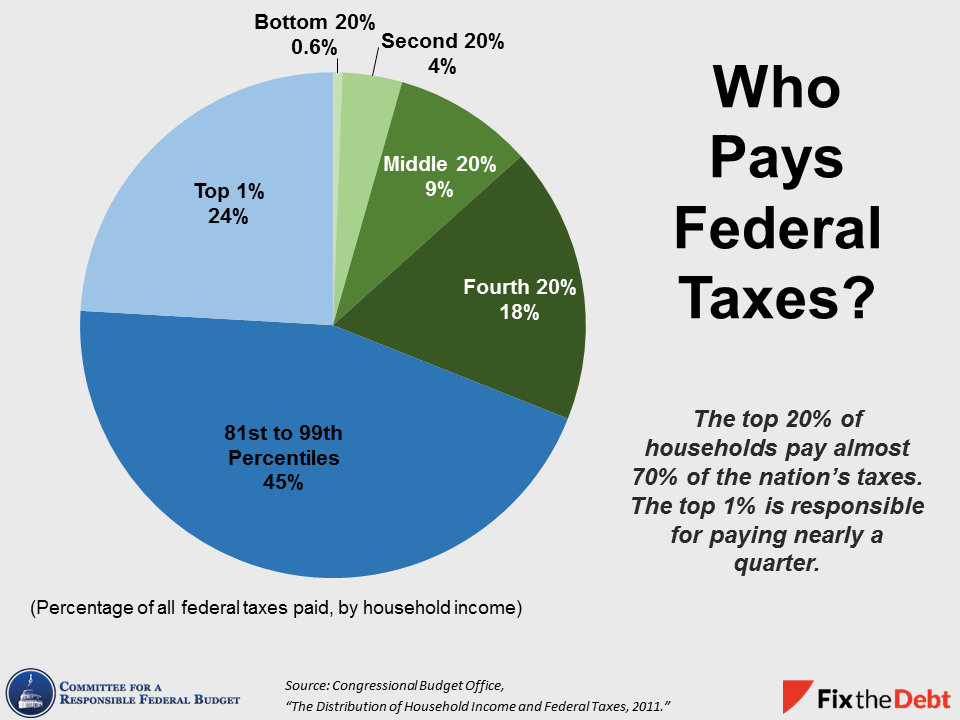

The Best How Many Percent Is Usa Tax 2022 finance News

Use this tool to: Estimate your federal income tax withholding. See how your refund, take-home pay or tax due are affected by withholding amount. Choose an estimated withholding amount that works for you. Results are as accurate as the information you enter.

How to Calculate Tax on Salary (With Example)

After getting a 2023 tax return estimate using the TaxCaster tax estimator for the 2024 tax filing season, it's time to plan. If you're expecting a refund, consider how you can use it wisely. Maybe it's time to boost your emergency fund, pay down debt, or invest in your future. If you owe taxes, start budgeting now to cover that upcoming expense.

Calculating federal tax per pay period GracieMaeAmi

State taxes. Marginal tax rate 5.85%. Effective tax rate 4.88%. New York state tax $3,413. Gross income $70,000. Total income tax -$11,074. After-Tax Income $58,926. Disclaimer: Calculations are.

How much taxes will I pay on a W9? YouTube

Estimate Federal Income Tax for 2020, 2019, 2018, 2017, 2016, 2015 and 2014, from IRS tax rate schedules. Find your total tax as a percentage of your taxable income.. Since taxes are calculated in tiers, the actual tax you pay as a percentage of your taxable income will always be less than your tax bracket. Net Income after Tax is paid.

How Much in Taxes Is Taken Out of Your Paycheck? Morningstar

The tax return and refund estimator will project your 2023-2024 federal income tax based on earnings, age, deductions and credits. Taxable income $86,150. Effective tax rate 16.6%. Estimated.

Salary calculator with tax deductions EaswarMirko

As your income goes up, the tax rate on the next layer of income is higher. When your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. You pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a single taxpayer. For a single taxpayer, the rates are:

How Much Tax and NI will I Pay I The Pearl Lemon Accounts

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by U.S. residents. The calculation is based on the 2024 tax brackets and the new W-4, which, in 2020, has had its first major.

How Do I Pay Employer Payroll Taxes? Employer Payroll Taxes Simplified! YouTube

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay, marital status, state and federal tax, and pay frequency. After using these inputs, you can estimate your take-home pay after taxes. The inputs you need to provide to use a paycheck tax calculator.

How much tax do you pay on your Mint

Income Tax Calculator: 1040 Tax Estimator. Enter your filing status, income, deductions and credits into the income tax calculator below and we will estimate your total taxes for 2016. Based on.

- Horarios Avant Ciudad Real Puertollano

- Pastel De Boda 4 Pisos

- Presupuestos Equipos Euroliga 23 24

- Temperature Sensor In Android Phone

- Alquiler Herramientas Aire Acondicionado Tarragona

- Crepes De Trigo Sarraceno Con Huevo

- Casa Rural La Viña Ciudad Rodrigo

- Costo De Un Riel De Cortina

- Convención Sobre Las Personas Con Discapacidad Onu

- Parte Europeo De Accidente Pdf