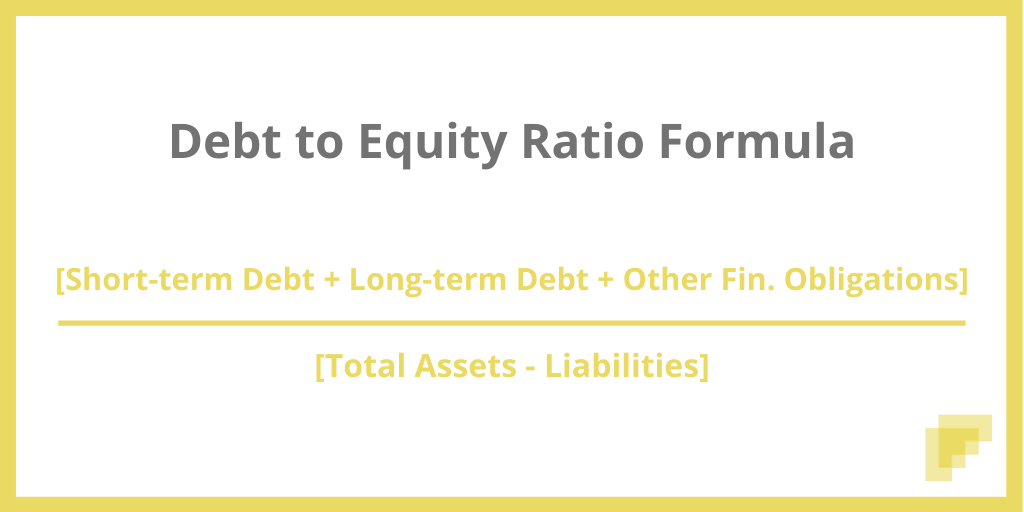

Debt to Equity Ratio Calculator Flow Capital

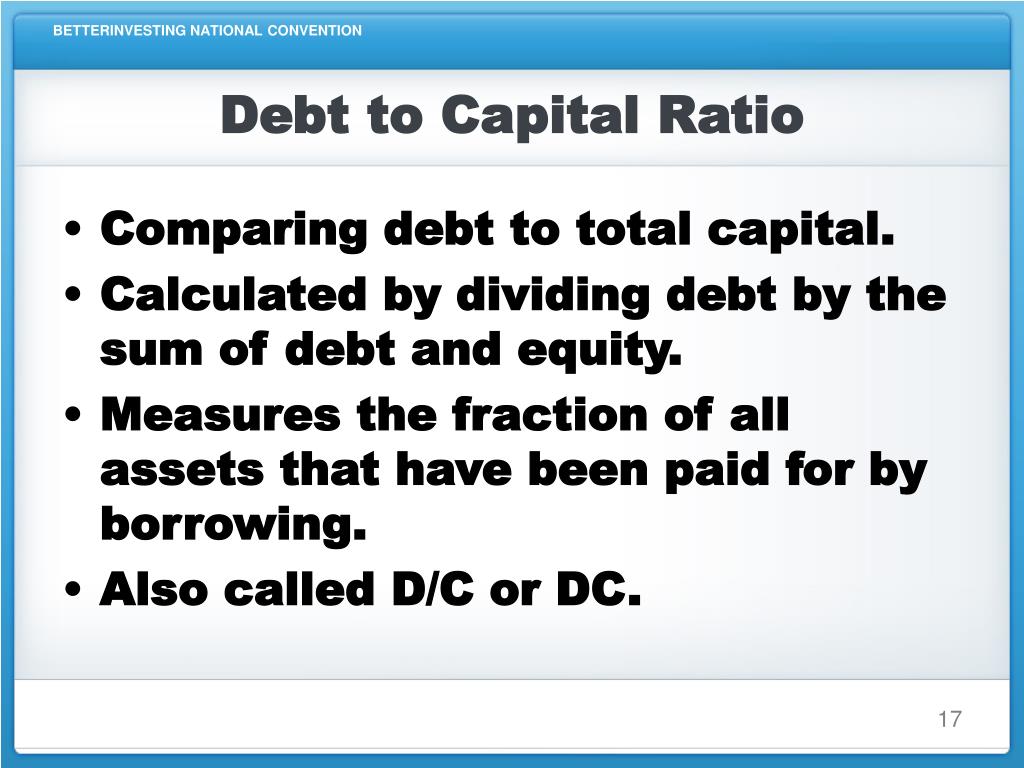

Debt-To-Capital Ratio: The debt-to-capital ratio is a measurement of a company's financial leverage . The debt-to-capital ratio is calculated by taking the company's debt , including both short.

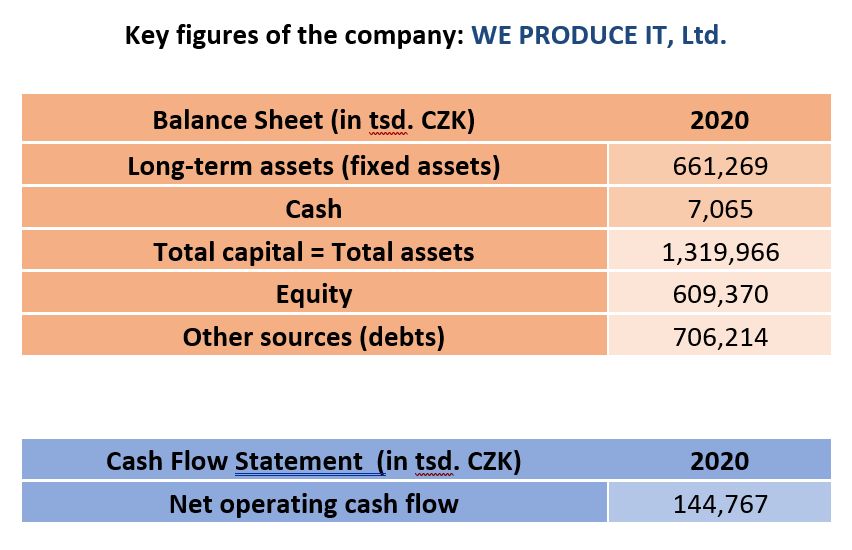

☝️ Cash flow and the company’s debt ratios

Based on the information in the table above, the REIT - Mortgage industry has the highest average debt to equity ratio of 3.13, followed by Resorts & Casinos at 2.4. In contrast, the Other Precious Metals & Mining industry has the lowest average debt to equity ratio of 0.04, followed by the Gold industry at 0.17.

What is Debt to Capital Ratio? Formula + Calculator

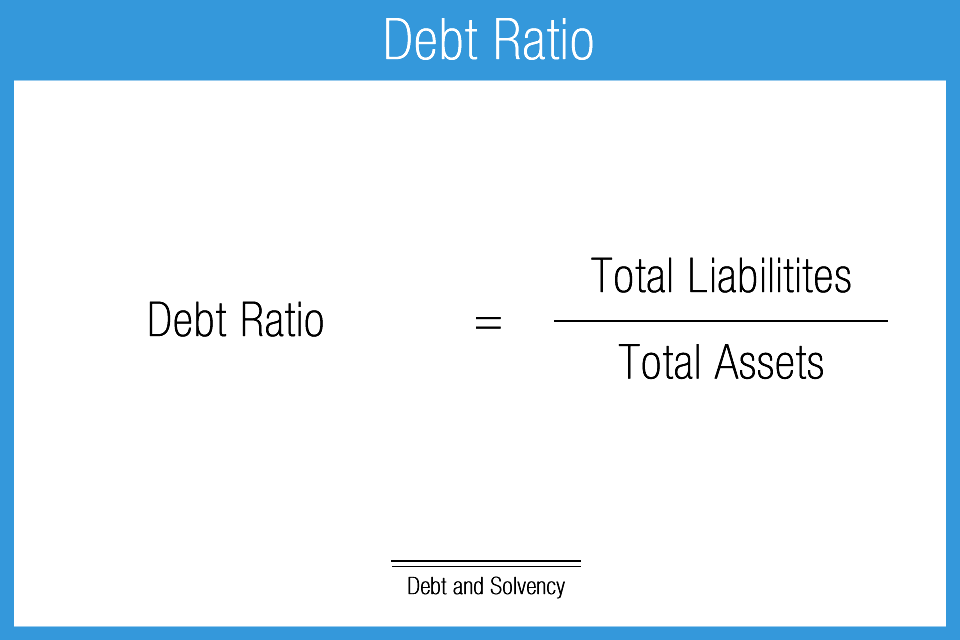

Debt Ratio: The debt ratio is a financial ratio that measures the extent of a company's leverage. The debt ratio is defined as the ratio of total debt to total assets, expressed as a decimal or.

Debt to Capital Ratio Debt Ratio FINED YouTube

By applying the formula, we can calculate the Debt-to-Total-Capital Ratio as follows: Debt-to-Total-Capital Ratio for Company A = ($5 million / $20 million) x 100 = 25%. Similarly, Company B has a total debt of $10 million and a total capitalization of $40 million. Using the formula, we can calculate the Debt-to-Total-Capital Ratio for Company.

Tỉ lệ nợ trên vốn (DebttoCapital Ratio D/C) là gì? Công thức tính

In general, many investors look for a company to have a debt ratio between 0.3 and 0.6. From a pure risk perspective, debt ratios of 0.4 or lower are considered better, while a debt ratio of 0.6.

Capital Structure DebtEquity Ratio Calculation Analysis

Debt-to-equity ratio - breakdown by industry. Debt-to-equity ratio (D/E) is a financial ratio that indicates the relative amount of a company's equity and debt used to finance its assets. Calculation: Liabilities / Equity. More about debt-to-equity ratio . Number of U.S. listed companies included in the calculation: 3617 (year 2023).

:max_bytes(150000):strip_icc()/Long-TermDebttoCapitalizationRatio_v2-b70165af646d45b29590b1a852aa8876.jpg)

LongTerm Debt to Capitalization Ratio Meaning and Calculations

Company ABC has $5 million in short-term obligation and $10 million in long-term obligation and has capital or equity amounting to $25 million. The debt-to-capital ratio would be calculated this way: Debt/Capital = Debt/ (Debt + Total Equity) = 5 + 10 / (15 + 25) = 15 / 40. = 0.375 or 37.5%.

Debt to Capital Ratio Formula and Interpretation Financial

Leverage ratio example #1. Imagine a business with the following financial information: $50 million of assets. $20 million of debt. $25 million of equity. $5 million of annual EBITDA. $2 million of annual depreciation expense. Now calculate each of the 5 ratios outlined above as follows: Debt/Assets = $20 / $50 = 0.40x.

Unlocking Financial Insights Calculating Debt and Profitability Ratios with Operating Loss

Debt-to-Capital Ratio = $2 million / ($2 million + $8 million) = $2 million / $10 million = 0.2 = 20%. So, Company XYZ has a Debt-to-Capital Ratio of 20%.. Comparative Analysis: Companies within the same industry can be compared using the Debt-to-Capital Ratio. This allows investors to identify companies with healthy financial structures and.

PPT Debt to Equity PowerPoint Presentation, free download ID4070466

Long Debt to Capital Ratio = Long-Term Debt ÷ Total Capitalization. In contrast to the prior formula, the method in which the total debt balance is used assesses not only the borrower's solvency risk but also the liquidity risk, i.e. long-term and short-term credit analysis. Short-Term Debt: Maturity <12 Months.

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

DebttoEquity (D/E) Ratio Formula and How to Interpret It

Debt-to-capital ratio = Debt/Debt + shareholder equity. In this formula, debt includes all of a company's short-term and long-term debt obligations. Shareholder equity covers all of the company's equity, including preferred stock, common stock and minority interest. So, say that a company has $20 million in debt and $30 million in.

Leverage Ratios Debt/Equity, Debt/Capital, Debt/EBITDA, Examples

This lists out inventory, accounts receivable, accounts payable and non-cash working capital by industry sector, as a percent of revenues. This data set reports return on equity (net income/book value of equity) by industry grouping and decomposes these returns into a pure return on capital and a leverage effect.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Capitalization_Ratios_Jan_2021-01-39b098a2a4f645ddb752bbd1887a488c.jpg)

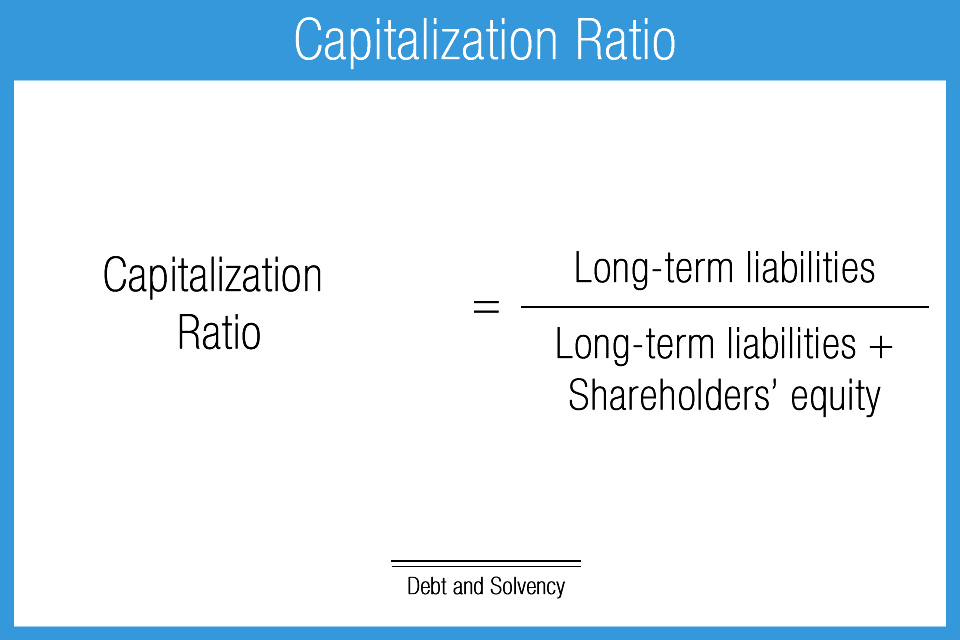

Capitalization Ratios Definition

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.. With a lower.

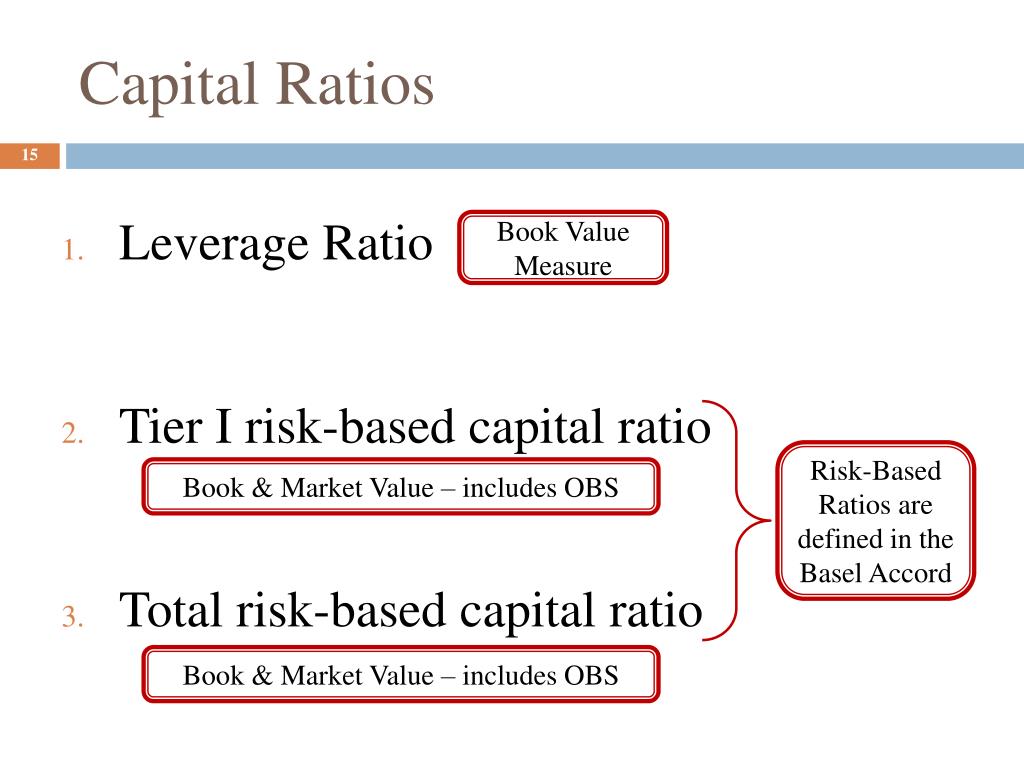

PPT Capital adequacy PowerPoint Presentation, free download ID6926836

A good debt to capital ratio percentage would depend on the average debt to capital ratio by industry. However, a percentage of less than 100 is considered an ideal debt to capital percentage because the higher the D/C ratio, the greater the risk to lenders and shareholders.

Debt and Solvency Ratios Accounting Play

Debt-to-capital ratio. A company's debt-to-capital ratio or D/C ratio is the ratio of its total debt to its total capital, its debt and equity combined. The ratio measures a company's capital structure, financial solvency, and degree of leverage, at a particular point in time. [1] The data to calculate the ratio are found on the balance sheet .

Business Illustration Showing the Concept of Debttocapital Rat Stock Illustration

Industry Name: Number of firms. Market Debt to Capital (Unadjusted) Market D/E (unadjusted) Market Debt to Capital (adjusted for leases) Market D/E (adjusted for leases) Interest Coverage Ratio: Debt to EBITDA: Effective tax rate: Institutional Holdings: Std dev in Stock Prices: EBITDA/EV: Net PP&E/Total Assets: Capital Spending/Total Assets.

- Locuri De Munca Focsani Fara Experienta

- Ac Dc Tour 2024 Ticketmaster

- Cuanto Tiempo Queda Para El Evento De Fortnite

- Control De Emision De Polvo A La Atmosfera Industria

- Golf Abierto De Estados Unidos

- Campamento De Verano Juan De Austria

- Aumentar Velocidad De Ram En Bios

- Coin Operated Timer Control Box

- Como Aumentar Mi Fuerza En Press De Banca

- Peña La Perla De Cadiz Actuaciones