What is a Bridge Loan? All You Need To Know

Bridge Loan Definition. A bridge loan is a financing option that serves as a source of funding until you get permanent financing or pay off debt. Also known as swing loans, bridge loans are typically short-term loans, lasting an average of 6 months to 1 year. They can be used to finance the purchase of a new home before selling your existing house.

Bridge Loans 101 The A Z Guide to Bridge Financing REtipster

A bridge loan, also known as a 'bridging loan', is a type of loan that's taken out for a short period of time until you secure the money you need - usually to help you buy a new home before you've sold your current property. Like other types of secured loan, bridge loans are secured against a valuable asset, usually your property.

What is a Bridge Loan? Pros and Cons of a Bridge Loan

Which banks offer bridge loans? A number of high street banks and private lenders offer bridging loans. Most of these are only available through loan brokers, as even high street banks do not normally offer bridge loans direct to the public. Some well-known banks that offer bridge loans include: NatWest. HSBC. Bank of Scotland. Barclays.

What is a bridge loan How do bridge loans work? YouTube

Barclays. Predominantly reserved for property developers, Barclays' bridging finance can also be used for personal and business projects, at the typical monthly interest rate for a high street bank, between 0.4 and 2%. Find out more about Barclays bridging loans.

:max_bytes(150000):strip_icc()/TermDefinitions_Template_bridgeloancopy-d328395628e94431ac99ef25b3f970b4.jpg)

What Is a Bridge Loan and How Does It Work, With Example

Bridge Loan: A bridge loan is a short-term loan used until a person or company secures permanent financing or removes an existing obligation. This type of financing allows the user to meet current.

Bridge Loan Explained YouTube

HSBC. Bank of Scotland. Barclays. Halifax. Lloyds. RBS. Santander. To apply for a high street bank bridging loan, you should consult a specialist loan broker, as banks are unlikely to lend directly to individuals. A bridge loan is a secured loan over a short period, usually no more than 12 months.

What is a Bridge Mortgage Loan and Why are They Growing in Popularity Right Now?

Bridging finance does pretty much exactly what it says on the tin, it is a loan that bridges a gap in property finance. It is a short-term loan that is there to help people finance a house purchase where a straight sale and purchase is not immediately possible. Bridging finance can be used in many different scenarios, but here are a few of the.

Bridge Loans Bridge Financing Toronto Ontario Canada YouTube

Bridging loans are a way to borrow a large amount of money for a short amount of time. They're most commonly used to 'bridge the gap' when buying property - for example, if you need to complete on a purchase before you've sold your current home. While they can be useful, they're high risk if things don't work out.

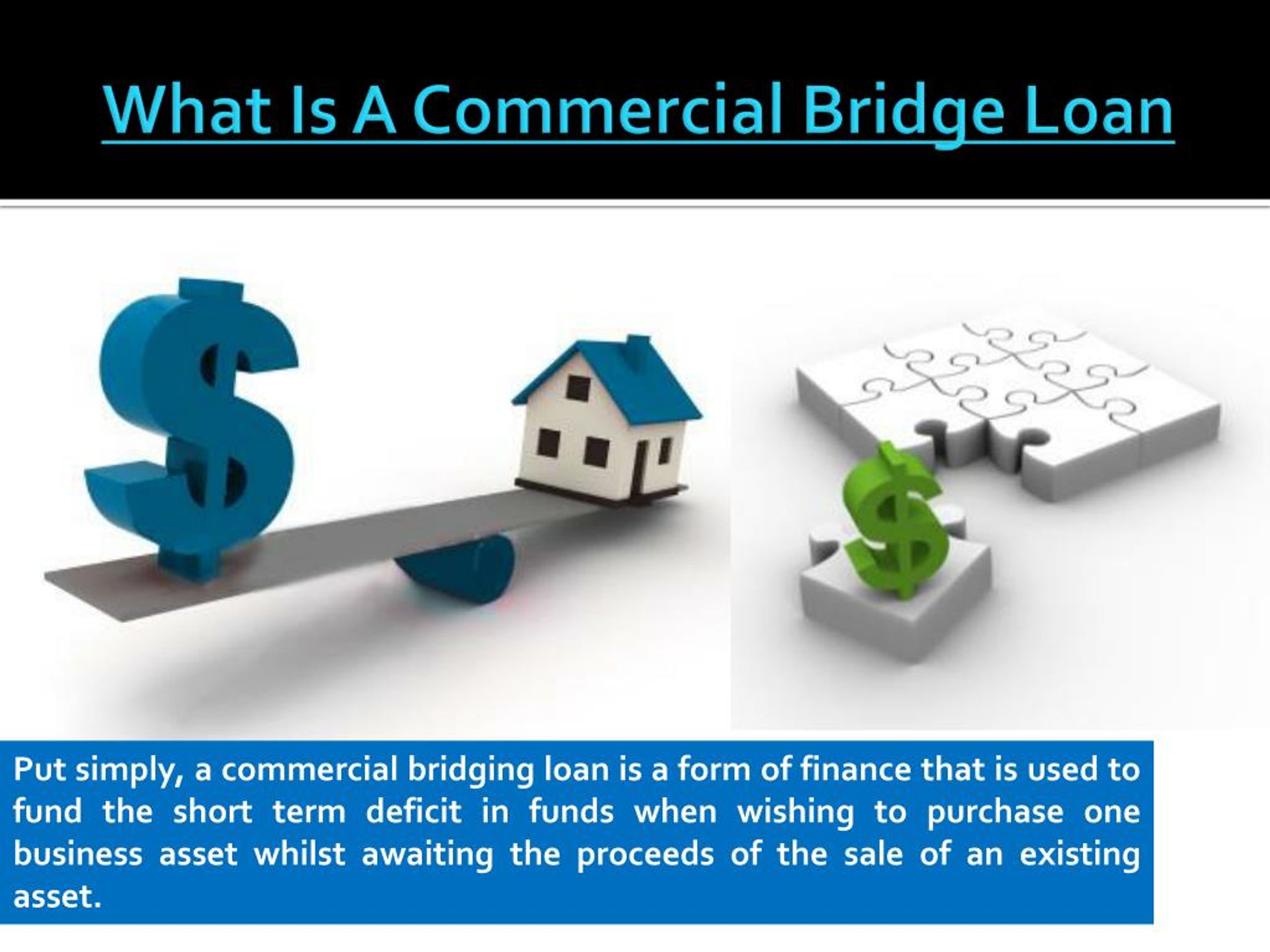

PPT Commercial Bridge Loans PowerPoint Presentation, free download ID7193345

A bridge loan is a short-term mortgage secured by a portion of the equity in your current home, even if it's for sale, to use toward the down payment on a new home. Your home equity is the difference between your home's value and the balance of your mortgage. Bridge loans are a good alternative to a cash-out refinance, which doesn't allow.

Bridge Loans Are Back Thank You, Leader Bank!!! cambridgeville

Get started. Our loan application process for a residential bridging loan is easy, fast & straightforward. Cut through the red tape with our hassle-free application process. We can typically confirm almost immediately whether your application is likely to be successful. Get in touch with our team of experts today!

How can you use bridge loans? in 2021 Personal loans, Loan, Bridge loan

Bank Bridging Loans - Top 10 Finance compare the top UK banks & all the UK's Bridging Finance Lenders for you - with over 100 lenders you need to make sure you're getting the best deals.. Bridge loans come with two different rate formats; fixed and variable. Fixed rate loans have an interest rate that is set in stone, meaning you'll.

PPT Commercial Bridge Loans PowerPoint Presentation, free download ID7193345

A bridging loan (or 'bridge loan') can be useful if you need to borrow money for a short period. It can help to 'bridge the gap' if you want to buy a new home before selling your old one.. Rather than taking months to secure, like traditional bank loans, they can be obtained within days - giving borrowers access to cash fast. It is possible.

Bridge Loans Explained for Real Estate Investing YouTube

Bridging loans bridge the gap between a long-term loan and a short-term need for capital. Banks in the UK have traditionally offered bridging loans, but in recent years, bridging loans have become a product more associated with specialist lenders. Banks in the UK mostly do not offer bridging loans anymore because they are seen as too risky.

Everything You Need to Know About Bridge Loans in 2021 Hard Money Lenders

What do Lloyds Bank interest rates look like on bridging finance? The average interest rate you can expect to pay for bridging finance is between 0.4% and 2%. It's important to compare lenders, though, because even a small increase in the bridging loan interest rate can mean you're paying back a lot more each month.

How and When to Use Bridge Loans in a Commercial Real Estate Deal

Bridge loans are short-term loans that help cover costs during transitional periods, most often the time frame between buying and selling a home. Like a mortgage, you might need to put your home.

Bridge Loans For Real Estate Investors What Is A Bridge Loan?

Loan term: From 12 to 36 months, depending on loan type. LTV: Up to 75%. Visit United Trust Bank. With United Trust Bank, the loan term differs depending on the bridging loan you take out. For example, you can choose up to 12 months for a regulated loan, whereas for an unregulated loan, it is up to 36 months.

- Auxiliar De Farmacia On Line

- Pasta De Dientes Casera Sin Bicarbonato

- Taylor Swift Carrito De Limpieza

- Dyson Cool Am07 Ventilador De Torre

- Atrapados En Una Ratonera Aguilas

- Prueba Opel Grandland X 1 6 180 Cv Gasolina

- Pisos Madrid Puente De Vallecas

- Modelo Denuncia Inspección De Trabajo Word

- Fusible Radio Seat Leon 2

- Little Wonder 10 Hp Blower